smart credit card purchases With responsible use, cardholders may be able to avoid falling into debt and see an improvement in credit scores. Here are five reasons why nearly every purchase should be made using a credit. NFC Occasionally not working. Just wondering if other people have had this issue. I open my .mh the sensor position on the pixel 2 is slightly different and the sensor seems to be smaller. Maybe thats the difference

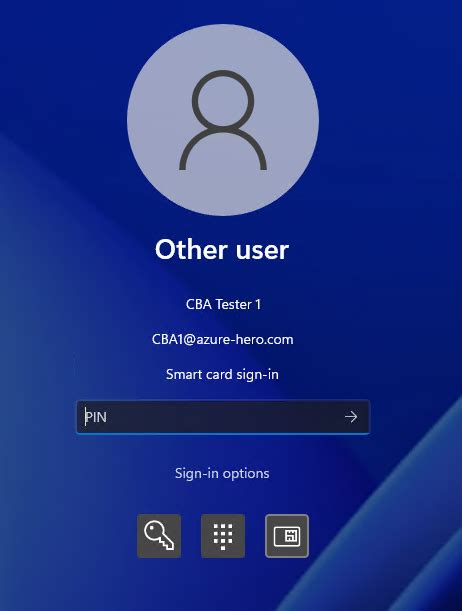

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

We have developed a product utilized the NFC readable/writable feature of NRF52832. We have tested it against some of the HTC, Sony, Samsung, and Google phones. .

Here are eight smart purchases you can make with your card. Key takeaways: Many credit cards offer rewards like miles or cash back on purchases, and the more you use your card, the more you can maximize those rewards. Only charging what you can afford to repay . Here are eight smart purchases you can make with your card. Key takeaways: Many credit cards offer rewards like miles or cash back on purchases, and the more you use your card, the more you can maximize those rewards. Only charging what you can afford to repay in full each month will help you avoid paying interest on your purchases. Find out what to always use a credit card to pay for, from groceries to travel — and what to never use a credit card for. With responsible use, cardholders may be able to avoid falling into debt and see an improvement in credit scores. Here are five reasons why nearly every purchase should be made using a credit.

Why Nearly Every Purchase Should Be on a Credit Card. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't. Which Purchases Should Go on Your Credit Card? Using your card for everyday spending can help you earn more rewards, but there are pitfalls to watch out for. Our Experts Financing a big purchase with a credit card can be smart, given there are no additional fees if you pay off the purchase in time. However, there are some other factors to consider. Keep reading to find out when to use your credit .NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Paying for an expensive purchase such as a home appliance or electronic device can be a smart way to use a credit card that offers purchase protection. Just make sure you pay that big purchase balance off as quickly as possible to avoid paying interest or running up too much credit card debt. If you make a big purchase on a credit card, it may bring you close to your credit limit. And unless you pay off the balance quickly, it could negatively impact your credit score. Smart people use credit cards to build credit, earn discounts, get cashback, and protect themselves from fraud. And when using a credit card for everyday purchases, there is no need to rack up unnecessary debt. Here are eight smart purchases you can make with your card. Key takeaways: Many credit cards offer rewards like miles or cash back on purchases, and the more you use your card, the more you can maximize those rewards. Only charging what you can afford to repay in full each month will help you avoid paying interest on your purchases.

Find out what to always use a credit card to pay for, from groceries to travel — and what to never use a credit card for. With responsible use, cardholders may be able to avoid falling into debt and see an improvement in credit scores. Here are five reasons why nearly every purchase should be made using a credit.

Why Nearly Every Purchase Should Be on a Credit Card. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't. Which Purchases Should Go on Your Credit Card? Using your card for everyday spending can help you earn more rewards, but there are pitfalls to watch out for. Our Experts Financing a big purchase with a credit card can be smart, given there are no additional fees if you pay off the purchase in time. However, there are some other factors to consider. Keep reading to find out when to use your credit .NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of 2024 – from generous rewards and giant sign-up bonuses to long 0% APR periods and.

Paying for an expensive purchase such as a home appliance or electronic device can be a smart way to use a credit card that offers purchase protection. Just make sure you pay that big purchase balance off as quickly as possible to avoid paying interest or running up too much credit card debt. If you make a big purchase on a credit card, it may bring you close to your credit limit. And unless you pay off the balance quickly, it could negatively impact your credit score.

smart card dump software

smartcard login

smart credit log in

smart credit cards to open

Buy NFC Reader/Writer Accessory - Nintendo 3DS - Nintendo from Nintendo - part of our .

smart credit card purchases|credit cards with no annual fee and no interest