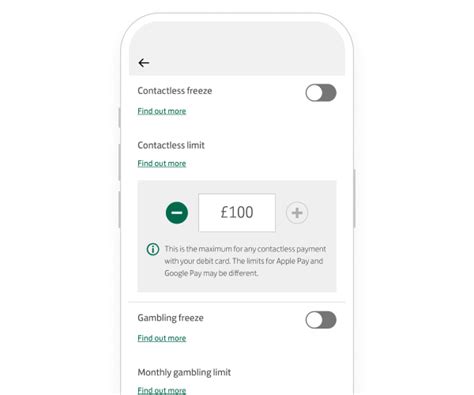

credit card contactless limit lloyds Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. The problems seems to be that it's not possible to emulate/modify the sector 0, which is often the UID (identifier). This question is linked (but probably outdated). It is possible .

0 · lloyds contactless payment limit uk

1 · lloyds contactless payment limit

2 · lloyds contactless not working

3 · lloyds contactless limit uk

4 · lloyds contactless card not working

5 · lloyds bank contactless payment limit

6 · contactless payment limit per day

7 · can you withdraw money contactless

Seattle Seahawks 17 at Philadelphia Eagles 9 on January 5th, 2020 - Full team and player stats and box score . Wild Card - Seattle Seahawks at Philadelphia Eagles - January 5th, 2020. via .Time (ET) / TV Tickets; AFC/NFC Wild-Card Round TBA at TBA . NFC Championship Game NFC at NFC : Site City TBD : 3:00pm ET FOX---AFC Championship Game AFC at AFC .

foxtel smart card for sale

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of .Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95.

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box.Freeze your card. Change your contactless limit. Report your card lost or stolen. Order a replacement card. Declined card

free h2o wireless smart sim card

The contactless card payment limit is rising from £45 to £100 on 15 October. But Bank of Scotland, Halifax, Lloyds and Starling will let you set your own limit, and others plan to do the same in future. Some providers will also let you turn off contactless completely. Here's what you need to know. The spending limit on each use of a contactless card has now risen from £45 to £100 - but not every shop will accept the new payment threshold. Retailers say it could take months to update. Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card. The three Lloyds Banking Group institutions are adding new card control functions to their mobile apps that will enable customers to choose a spending limit of between £30 (US) and £95 (US0) and switch their card’s contactless functionality on and off.

According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic – the contactless limit was increased .Pay up to £100 by holding your card against a reader if your card is contactless. There’s no need to enter your PIN. Your contactless cards still have the same anti fraud protection as chip and PIN. Change your contactless limit to anything between £30 and £95.

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box.Freeze your card. Change your contactless limit. Report your card lost or stolen. Order a replacement card. Declined card

The contactless card payment limit is rising from £45 to £100 on 15 October. But Bank of Scotland, Halifax, Lloyds and Starling will let you set your own limit, and others plan to do the same in future. Some providers will also let you turn off contactless completely. Here's what you need to know. The spending limit on each use of a contactless card has now risen from £45 to £100 - but not every shop will accept the new payment threshold. Retailers say it could take months to update.

Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card.

The three Lloyds Banking Group institutions are adding new card control functions to their mobile apps that will enable customers to choose a spending limit of between £30 (US) and £95 (US0) and switch their card’s contactless functionality on and off.

lloyds contactless payment limit uk

lloyds contactless payment limit

lloyds contactless not working

The Credit Card Reader NFC (EMV) app allows you to retrieve data from your bank card. The developers have tried and created the simplest possible program, which copes with its task perfectly. To work with it, you will .

credit card contactless limit lloyds|lloyds contactless payment limit uk