how secure is contactless debit card Often referred to as “tap-and-pay,” contactless cards are debit and credit cards equipped with technology that allows you to pay for purchases by tapping your card on a merchant’s card reader. That means there’s no need to swipe or insert a card, enter a PIN, or sign a receipt to make a debit or credit card purchase.

The usual "it depends". Check the datasheet of the cards you want to work with. I found out .Retrieved 16 February 2017. ^ Galaxy S IV Mini (Variant) SCH-I435, Samsung, 14 June 2014. ^ Galaxy S IV Mini (Variant) SM-S890L (PDF), Samsung, 14 June 2014. ^ Turkcell T40 Aygün, Turkcell. ^ Vodafone Smart III, Vodafone, archived from the original on 30 June 2013, retrieved 27 June 2013. ^ "NXP . See more

0 · is contactless debit card safe

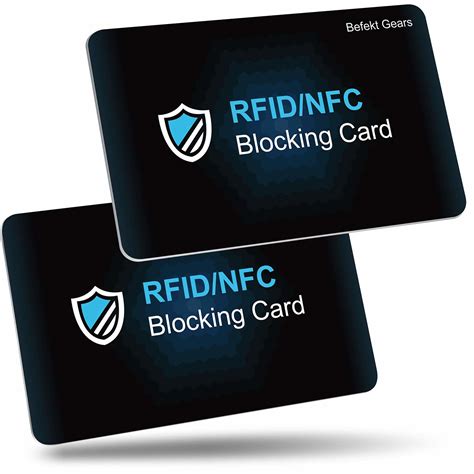

1 · how to protect contactless card

2 · how to do contactless payment

3 · how safe is contactless payment

4 · contactless payment security

5 · contactless debit card fraud

6 · contactless card security issues

7 · can contactless cards be skimmed

Time, TV schedule. TV Channel: SEC Network. Start time: 11:45 a.m. CT. Auburn vs. ULM will be broadcast nationally on SEC Network in Week 12 of the college football season. Taylor Zarzour and Matt Stinchcomb will call the .

How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company.

How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company. While security features are included on contactless cards, mobile wallets may offer better security by requiring biometric inputs or other security.Since the chips are virtually impossible to tamper with or clone, EMV cards are infinitely less vulnerable to counterfeit fraud than magnetic stripe cards. The EMV standard continuously evolves to include new security defence mechanisms, such .Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. When you pay with a contactless card, the embedded EMV chip encrypts your account information so your data can’t be stolen.

Often referred to as “tap-and-pay,” contactless cards are debit and credit cards equipped with technology that allows you to pay for purchases by tapping your card on a merchant’s card reader. That means there’s no need to swipe or insert a card, enter a PIN, or sign a receipt to make a debit or credit card purchase.

is contactless debit card safe

how to protect contactless card

The major benefits of contactless payments include safety, because you aren't touching as many surfaces to pay, and speed, because you don't have to sign or enter your PIN. Contactless payments also help to prevent fraud by generating a unique code for each transaction. Contactless credit cards and debit cards are a safe and secure way to pay for things for many reasons. When you choose to ‘tap’ over ‘swipe,’ you avoid the threat of skimmers installed on the device that could steal your financial information from your card’s mag stripe. Finally, contactless debit cards are more secure than traditional cards. They have a built-in security feature called 'tokenization', which means that your card number is never stored on the terminal or shared with the merchant. This makes it . All contactless payments require a person’s card or a compatible smartphone wallet app and password. The theft of any of those could put you at risk of contactless payment fraud. Consider the example where you use a contactless-enabled card at a busy outlet, such as a shopping center or gas station.

Find out how contactless payment cards work, the limit on contactless payments, if contactless cards are safe to use, all about contactless protectors and whether you can cancel or opt out of contactless cards. How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company. While security features are included on contactless cards, mobile wallets may offer better security by requiring biometric inputs or other security.

Since the chips are virtually impossible to tamper with or clone, EMV cards are infinitely less vulnerable to counterfeit fraud than magnetic stripe cards. The EMV standard continuously evolves to include new security defence mechanisms, such .Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. When you pay with a contactless card, the embedded EMV chip encrypts your account information so your data can’t be stolen.

how to do contactless payment

Often referred to as “tap-and-pay,” contactless cards are debit and credit cards equipped with technology that allows you to pay for purchases by tapping your card on a merchant’s card reader. That means there’s no need to swipe or insert a card, enter a PIN, or sign a receipt to make a debit or credit card purchase.The major benefits of contactless payments include safety, because you aren't touching as many surfaces to pay, and speed, because you don't have to sign or enter your PIN. Contactless payments also help to prevent fraud by generating a unique code for each transaction.

Contactless credit cards and debit cards are a safe and secure way to pay for things for many reasons. When you choose to ‘tap’ over ‘swipe,’ you avoid the threat of skimmers installed on the device that could steal your financial information from your card’s mag stripe. Finally, contactless debit cards are more secure than traditional cards. They have a built-in security feature called 'tokenization', which means that your card number is never stored on the terminal or shared with the merchant. This makes it . All contactless payments require a person’s card or a compatible smartphone wallet app and password. The theft of any of those could put you at risk of contactless payment fraud. Consider the example where you use a contactless-enabled card at a busy outlet, such as a shopping center or gas station.

configure server 2016 ca for smart card authentication

how safe is contactless payment

ESPN 106.7 is Auburn-Opelika’s radio connection to ESPN, the worldwide leader in sports. From local sports shows including the Auburn High School Football Preview along with ESPN’s top-tier daily lineup, SportsCenter updates, .

how secure is contactless debit card|can contactless cards be skimmed