how safe are contactless debit cards Are contactless payments safe? Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic.

Vintage (1994) NFC Green Bay Packers playing cards NFL licensed NEW. Skip to main .

0 · is contactless debit card safe

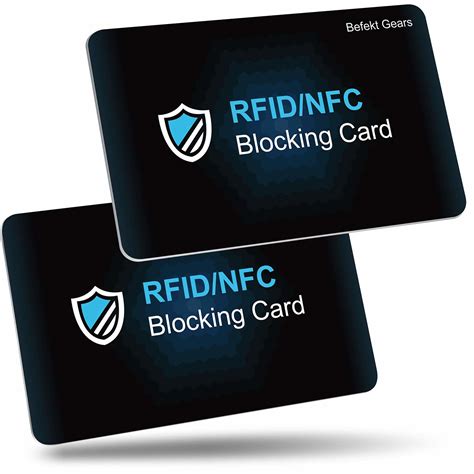

1 · how to protect contactless card

2 · how to do contactless payment

3 · how safe is contactless payment

4 · contactless payment security

5 · contactless debit card fraud

6 · contactless card security issues

7 · can contactless cards be skimmed

Hi Samsung, as i survey arround that china version Samsung Pay can add RFID .

How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company. How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company.Since the chips are virtually impossible to tamper with or clone, EMV cards are infinitely less vulnerable to counterfeit fraud than magnetic stripe cards. The EMV standard continuously evolves to include new security defence mechanisms, such .

While security features are included on contactless cards, mobile wallets may offer better security by requiring biometric inputs or other security. While both options offer heightened security, tap-to-pay cards include an extra layer of convenience. In this article, we’ll highlight the technology and security behind tap-to-pay cards and provide tips to keep your accounts safe when using contactless payments.Are contactless payments safe? Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. Connected Devices and Contactless Payments. Security concerns surrounding stolen connected devices, like smartphones or smartwatches, are mitigated by contactless commerce design. Devices store minimal information, .

Contactless payments are generally considered to be a secure payment method. In this article, learn about the various touch-free ways to pay, the potential pros and cons of these payment methods, and what helps make contactless payments safe.

is contactless debit card safe

As the name implies, contactless payments do not require any physical contact between a credit card, debit card, or any other device and the checkout terminal/card reader. Contactless payments utilize NFC (near field communication), a type of radio frequency identification (called RFID). Eager to avoid the keypad when shopping? Consumer Reports explains how contactless payment services like Apple Pay, Google Pay, and RFID cards can help. Are contactless cards safe? Broadly, yes. The £100-per-transaction limit is one safeguard, and card issuers also restrict the number of consecutive contactless transactions that can be made before the Pin is requested. Contactless card fraud on payment cards and devices reached £34.9million in 2022. How Safe Is a Contactless Debit Card? Unlike making an online or phone payment where you need to provide your name, CVV code and ZIP code, contactless debit cards use touchless one-time encryption to read and transmit your data to your credit card company.

Since the chips are virtually impossible to tamper with or clone, EMV cards are infinitely less vulnerable to counterfeit fraud than magnetic stripe cards. The EMV standard continuously evolves to include new security defence mechanisms, such .

how to protect contactless card

While security features are included on contactless cards, mobile wallets may offer better security by requiring biometric inputs or other security. While both options offer heightened security, tap-to-pay cards include an extra layer of convenience. In this article, we’ll highlight the technology and security behind tap-to-pay cards and provide tips to keep your accounts safe when using contactless payments.

Are contactless payments safe? Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic.

Connected Devices and Contactless Payments. Security concerns surrounding stolen connected devices, like smartphones or smartwatches, are mitigated by contactless commerce design. Devices store minimal information, . Contactless payments are generally considered to be a secure payment method. In this article, learn about the various touch-free ways to pay, the potential pros and cons of these payment methods, and what helps make contactless payments safe.

As the name implies, contactless payments do not require any physical contact between a credit card, debit card, or any other device and the checkout terminal/card reader. Contactless payments utilize NFC (near field communication), a type of radio frequency identification (called RFID). Eager to avoid the keypad when shopping? Consumer Reports explains how contactless payment services like Apple Pay, Google Pay, and RFID cards can help.

articles on rfid tags

benefits of rfid ear tags

how to do contactless payment

$2.45

how safe are contactless debit cards|how to protect contactless card