atm nfc vs card To check if a card has RFID or NFC, follow these steps: Unlock your . Chinese manufacturer Netcom has developed an NFC chip that integrates with a micro-SD .

0 · rfid or nfc card

1 · how to use atm card

2 · cardless atm mobile wallet

3 · cardless atm card codes

4 · cardless atm card

5 · can you use cardless atms

6 · banks with cardless atms

7 · bank of America cardless atms

“Tag” emulation would be a better name as the NFC device is emulating a NFC tag, but NFC .

NFC technology in ATM cards offers a more convenient and secure way of making transactions compared to traditional ATM cards. With NFC-enabled cards, users can simply tap their card on a contactless reader to complete a payment, eliminating the need to swipe or . To check if a card has RFID or NFC, follow these steps: Unlock your .

NFC technology in ATM cards offers a more convenient and secure way of making transactions compared to traditional ATM cards. With NFC-enabled cards, users can simply tap their card on a contactless reader to complete a payment, eliminating the .

To check if a card has RFID or NFC, follow these steps: Unlock your smartphone and enable NFC in the settings menu. Hold the card close to the back of your phone, where the NFC antenna is usually located. If the card is NFC enabled, your phone will detect it and may prompt you with options or display relevant information. A cardless ATM lets you withdraw cash using your mobile or other smart device instead of a physical debit card. They tend to use the same technology as used in contactless payments, called near-field communications or NFC.

Contactless payments, including Visa contactless cards, Google Pay and Apple Pay, use the same NFC (Near Field Communication) technology. Samsung Pay, however, works with both NFC technology and MST (Magnetic Secure Transition) technology, which can be . Key takeaways. Some ATMs do not require a debit card to withdraw cash or make deposits, but you will need your smartphone to verify your identity. The majority of cardless ATMs are currently.

rfid or nfc card

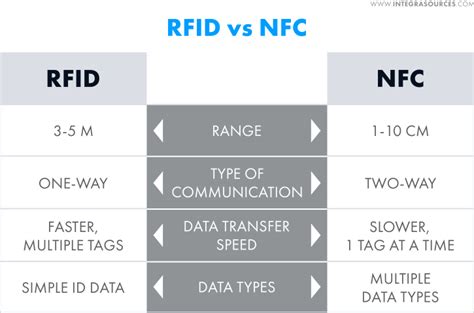

Today’s cards typically use a version of RFID called near-field communication, or NFC, which operates at a higher frequency and allows for faster data transfer, but only at close distances — a few inches.

NFC chips have enabled us to pay in a more convenient way, but there are several flaws which can make the experience less secure.Contactless debit cards are also known as Wi-Fi debit cards. They work on RFID or NFC technology. You can make payments without swiping the card. You can recognise the card with the Wi-Fi symbol embossed on it. Contactless debit cards enable secure and speedy payments.

Cardless ATM access allows customers to access Chase ATMs using an eligible Chase debit card that has been loaded into an Apple Pay, Google Wallet ™ or Samsung Pay mobile wallet. Once you have successfully loaded your card into your mobile wallet, you no longer need to have your physical card to make transactions at Chase ATMs.

Here’s a breakdown between EMV vs. NFC payments—and why it makes sense to start accepting both at your business. And if you want an even deeper dive into EMV chip cards and NFC payments check out our comprehensive guides (linked above).

how to use atm card

NFC technology in ATM cards offers a more convenient and secure way of making transactions compared to traditional ATM cards. With NFC-enabled cards, users can simply tap their card on a contactless reader to complete a payment, eliminating the .

To check if a card has RFID or NFC, follow these steps: Unlock your smartphone and enable NFC in the settings menu. Hold the card close to the back of your phone, where the NFC antenna is usually located. If the card is NFC enabled, your phone will detect it and may prompt you with options or display relevant information. A cardless ATM lets you withdraw cash using your mobile or other smart device instead of a physical debit card. They tend to use the same technology as used in contactless payments, called near-field communications or NFC.

Contactless payments, including Visa contactless cards, Google Pay and Apple Pay, use the same NFC (Near Field Communication) technology. Samsung Pay, however, works with both NFC technology and MST (Magnetic Secure Transition) technology, which can be . Key takeaways. Some ATMs do not require a debit card to withdraw cash or make deposits, but you will need your smartphone to verify your identity. The majority of cardless ATMs are currently.

Today’s cards typically use a version of RFID called near-field communication, or NFC, which operates at a higher frequency and allows for faster data transfer, but only at close distances — a few inches. NFC chips have enabled us to pay in a more convenient way, but there are several flaws which can make the experience less secure.

Contactless debit cards are also known as Wi-Fi debit cards. They work on RFID or NFC technology. You can make payments without swiping the card. You can recognise the card with the Wi-Fi symbol embossed on it. Contactless debit cards enable secure and speedy payments.Cardless ATM access allows customers to access Chase ATMs using an eligible Chase debit card that has been loaded into an Apple Pay, Google Wallet ™ or Samsung Pay mobile wallet. Once you have successfully loaded your card into your mobile wallet, you no longer need to have your physical card to make transactions at Chase ATMs.

cardless atm mobile wallet

greater anglia smart card

how to use two credit cards smartly

Tapping to pay with your Visa contactless card or payment-enabled mobile/wearable device is .Here are the top 10 creative ways NFC business cards can be used, bringing .

atm nfc vs card|cardless atm card codes