credit card companies getting smarter about fee The following are questions credit card issuers should be asking themselves or looking into to get ahead of future revisions to Regulation Z: Can you demonstrate how you determined late-fee amounts are proportionate to collection costs? Are you following the Fed’s safe harbor limit provisions? Here's how to use NFC on the iPhone & all you need to know about the feature. Learn how to label and read NFC tags on all iPhone models!

0 · mastercard credit card fees

1 · how to increase credit card fees

2 · credit card transfer fee increase

Near Field Communication (NFC) is unique in that it can transmit power as well as data. Complimentary to Wireless Power Consortium's Qi induction charging platform, which delivers up to 15W over a distance of 4cm. NFC Wireless Charging Specification currently offers induction charging up to 1W over a distance of up to 2cm.

Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress. A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge .

smart travel card london

Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress. A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge customers paying with a credit card an extra fee. The following are questions credit card issuers should be asking themselves or looking into to get ahead of future revisions to Regulation Z: Can you demonstrate how you determined late-fee amounts are proportionate to collection costs? Are you following the Fed’s safe harbor limit provisions?

Retailers have been complaining that credit card companies have the upper hand - charging them "swipe fees" when customers use cards. A bipartisan bill is in the works that could change.

smart talk phone says invalid sim card

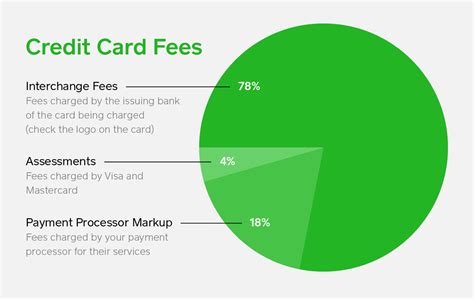

Credit card processing fees can add up to a big expense for merchants. Here are the average fees and costs for many issuers and payment networks in 2024. Although these cards may offer perks like travel points, cashback or exclusive benefits, the annual fee can range from to well over 0, depending on the card. How to avoid this fee: Some . Reducing your credit card processing fees doesn’t have to be a complicated process. By understanding what drives your costs, leveraging tools like Level 2 and 3 data, maximizing discounts, and exploring options to pass fees on to customers, you can take control of your fees and start saving. 9 credit card fees you don’t have to pay. If you want to use credit to your advantage, try to avoid unnecessary credit card fees and charges. Below, you’ll find nine common credit.

smart time card solutions for hotels

It’s true: credit card fees cost them money on each transaction. But not taking credit cards could cost them more business in the long run. So what’s the right thing to do for you as a.

Below is a deep dive into credit card surcharges for businesses: how they work, what benefits they can provide, and best practices for implementing credit card surcharges in a strategic way that doesn’t undermine customer satisfaction. Merchants paid 6 billion in credit card fees in 2022, up 20% from 2021, The pushback is playing out in lobbying campaigns and Congress. A 2022 study released by The Straw Group (an analytics company specializing in the payments industry) found 23% of small businesses charge customers paying with a credit card an extra fee. The following are questions credit card issuers should be asking themselves or looking into to get ahead of future revisions to Regulation Z: Can you demonstrate how you determined late-fee amounts are proportionate to collection costs? Are you following the Fed’s safe harbor limit provisions?

Retailers have been complaining that credit card companies have the upper hand - charging them "swipe fees" when customers use cards. A bipartisan bill is in the works that could change.

Credit card processing fees can add up to a big expense for merchants. Here are the average fees and costs for many issuers and payment networks in 2024.

Although these cards may offer perks like travel points, cashback or exclusive benefits, the annual fee can range from to well over 0, depending on the card. How to avoid this fee: Some . Reducing your credit card processing fees doesn’t have to be a complicated process. By understanding what drives your costs, leveraging tools like Level 2 and 3 data, maximizing discounts, and exploring options to pass fees on to customers, you can take control of your fees and start saving.

mastercard credit card fees

how to increase credit card fees

9 credit card fees you don’t have to pay. If you want to use credit to your advantage, try to avoid unnecessary credit card fees and charges. Below, you’ll find nine common credit. It’s true: credit card fees cost them money on each transaction. But not taking credit cards could cost them more business in the long run. So what’s the right thing to do for you as a.

credit card transfer fee increase

smart sketcher cards

smart switch samsung restore new sd card

There are several ways you can link someone to your contact details, depending on what digital platform you use. For . See more

credit card companies getting smarter about fee|mastercard credit card fees