how to be smart with your credit card Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards.

Of course you can’t. Some schools are piloting an authorized digital pass card using the iOS wallet, but it has not been widely adopted yet. -2. Reply. calsutmoran. • 1 yr. ago. You can try “nfc tools” but it would only work with .

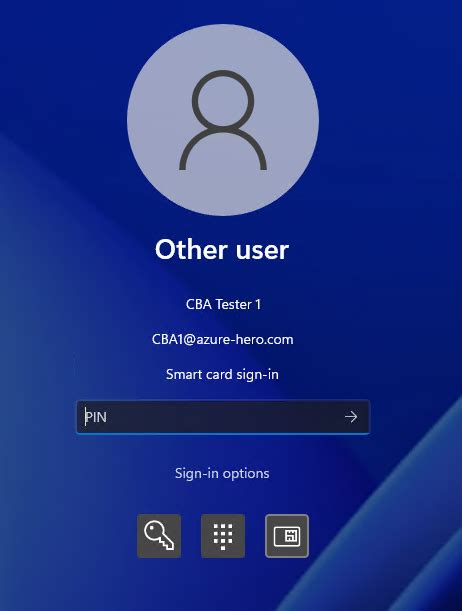

0 · smartcard login

1 · smart credit log in

2 · smart credit cards to open

3 · smart card terms and conditions

4 · smart card identity card

5 · smart card identification

6 · exxon smart card credit log

7 · credit cards with no annual fee and no interest

What is NFC, and how does it work? NFC, which is short for near-field communication, is a technology that allows devices like phones and .

Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus,. Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor.Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full.

Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies.

Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards. How to Use Your Credit Card. Being smart about how you use credit cards makes your financial life easier. Here are a few good credit card habits to get into. 1. Think about your credit card as what it really is: a loan.

Get essential tips for maximizing credit card rewards, building credit, and managing finances with our guide. But what’s the best way to use a credit card to your advantage? We’ll explore four key strategies, including building credit, earning rewards, paying down debt and financing a purchase. We’ll also share some tips for getting the most out of your credit card without racking up unnecessary debt or negatively impacting your credit.

smartcard login

1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit cards. Smart people use credit cards to build credit, earn discounts, get cashback, and protect themselves from fraud. And when using a credit card for everyday purchases, there is no need to rack up unnecessary debt. Using a credit card to pay for day-to-day purchases is a smart idea. Paying with credit is convenient, it's generally safer than using cash or debit, and it can be highly rewarding. Plus,.

Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor.

Here are dozen tips on how to be smart about using credit cards: 1. Set a budget. Set a realistic budget on what you can spend and pay off your balance, or as much as you can, before the end of your card’s monthly billing cycle. A credit card is great for shopping conveniently - not for buying things you can’t afford. 2. Pay your bills in full.

Stay on top of your monthly payments and avoid costly fees and interest charges with these smart credit card strategies. Follow these steps to use your credit card wisely as a tool for improving your credit and maximizing rewards. How to Use Your Credit Card. Being smart about how you use credit cards makes your financial life easier. Here are a few good credit card habits to get into. 1. Think about your credit card as what it really is: a loan. Get essential tips for maximizing credit card rewards, building credit, and managing finances with our guide.

But what’s the best way to use a credit card to your advantage? We’ll explore four key strategies, including building credit, earning rewards, paying down debt and financing a purchase. We’ll also share some tips for getting the most out of your credit card without racking up unnecessary debt or negatively impacting your credit. 1. Pick a card that works for you. As long as you take the time to choose a credit card wisely, using a credit card can be a smart way to shop. There are several types of credit cards.

what do you mean by smart card

where to find my dstv smart card number

$17.99

how to be smart with your credit card|credit cards with no annual fee and no interest