direct transmission chase smart cards Have a question about wire transfers, like Can you cancel a wire transfer? Chase's wire transfer FAQs can help you answer your wire transfer questions. Unlock your iPhone and navigate to the home screen. Go to the “Settings” app, which is identified by the gear icon. Scroll down and tap on “NFC” from the list of available options. On the NFC screen, you will find a toggle .

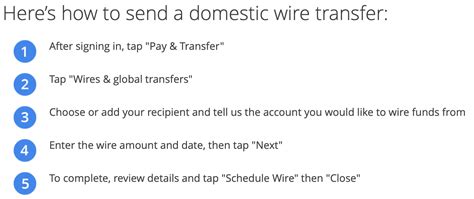

0 · chase wire transfer process

1 · chase wire transfer payment

2 · chase wire transfer customer service

3 · chase secure checking wire transfer

4 · chase international wire transfers

5 · chase global wire transfer limit

6 · chase for business wire transfer

7 · chase bank wire transfer limit

NFC id 2. NFC Technologies 3. NFC type (Mifare Classic/Ultralight) Note: We will be using the Mifare Ultralight C for this guide. Step 0: AndroidManifest.xml, Allow NFC permissions for our app

Have a question about wire transfers, like Can you cancel a wire transfer? Chase's wire transfer FAQs can help you answer your wire transfer questions. What is Chase Payment Solutions? Chase Payment Solutions is a payments processor and an acquiring bank in merchant transactions. These kinds of providers — often .Our secure API lets you choose the accounts you share. And you can use our Chase mobile app or chase.com to check who has access to that information and to stop sharing it at any time.Answer to Reset (ATR) is the response output by a Smart Card ICC conforming to ISO/IEC 7816 standards, following electrical reset of the card’s chip by a card reader. The ATR conveys .

Smart Card A payment card with a built-in microprocessor (chip) that stores information. Smart cards can be used for stored-value cards, credit cards, loyalty programs and security access.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible .Have a question about wire transfers, like Can you cancel a wire transfer? Chase's wire transfer FAQs can help you answer your wire transfer questions. What is Chase Payment Solutions? Chase Payment Solutions is a payments processor and an acquiring bank in merchant transactions. These kinds of providers — often called direct processors — offer.

Our secure API lets you choose the accounts you share. And you can use our Chase mobile app or chase.com to check who has access to that information and to stop sharing it at any time.Answer to Reset (ATR) is the response output by a Smart Card ICC conforming to ISO/IEC 7816 standards, following electrical reset of the card’s chip by a card reader. The ATR conveys information about the communication parameters proposed .Smart Card A payment card with a built-in microprocessor (chip) that stores information. Smart cards can be used for stored-value cards, credit cards, loyalty programs and security access.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it .

Chase Payment Solutions, formerly Chase Merchant Services, is a popular direct payment processor that offers fraud protection and 24/7 access to customer service. With over trillion in. Protect your customer’s payment data by replacing card account information with a token. By doing so you’ll avoid storing sensitive details that could be targeted by hackers.

Direct transmission and Host-to-Host up to 90 days in advance. J.P. Morgan Access ® up to 60 days in advance. Chase Connect ® up to 360 days in advance. If you are unable to send ACH files via direct transmission, you can initiate through J.P. Morgan Access or Chase Connect. 1.For questions about your Chase QuickAccept and Card Payments, contact our customer support team at 888-659-4961, or explore other card payment support topics. For information about our complete suite of solutions, visit our homepage.Have a question about wire transfers, like Can you cancel a wire transfer? Chase's wire transfer FAQs can help you answer your wire transfer questions. What is Chase Payment Solutions? Chase Payment Solutions is a payments processor and an acquiring bank in merchant transactions. These kinds of providers — often called direct processors — offer.

Our secure API lets you choose the accounts you share. And you can use our Chase mobile app or chase.com to check who has access to that information and to stop sharing it at any time.Answer to Reset (ATR) is the response output by a Smart Card ICC conforming to ISO/IEC 7816 standards, following electrical reset of the card’s chip by a card reader. The ATR conveys information about the communication parameters proposed .Smart Card A payment card with a built-in microprocessor (chip) that stores information. Smart cards can be used for stored-value cards, credit cards, loyalty programs and security access.

Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it . Chase Payment Solutions, formerly Chase Merchant Services, is a popular direct payment processor that offers fraud protection and 24/7 access to customer service. With over trillion in. Protect your customer’s payment data by replacing card account information with a token. By doing so you’ll avoid storing sensitive details that could be targeted by hackers.

Direct transmission and Host-to-Host up to 90 days in advance. J.P. Morgan Access ® up to 60 days in advance. Chase Connect ® up to 360 days in advance. If you are unable to send ACH files via direct transmission, you can initiate through J.P. Morgan Access or Chase Connect. 1.

commercial rfid tracking system

chase wire transfer process

chase wire transfer payment

chase wire transfer customer service

For the Contactless cards data Research and Development or Test Cards Simulation we support few Android Handy Tools presented in the Google Play Market. See the features comarison between the applications. . please contact [email protected]. Features comparison. NFC Reader iso8583.info tools. NFC card info reader. Guest access. iso8583 .

direct transmission chase smart cards|chase international wire transfers