is it smart to get a load for credit cards Using a personal loan for credit card debt is a form of debt consolidation, and there are a lot of advantages to consolidating your debt into a single monthly payment. Here are three of the.

You can activate your card (s) by tapping them onto your phone, or if you have an older device, .

0 · Using A Personal Loan To Pay Off Credit Card Debt

1 · Should You Take Out a Personal Loan to Pay Off Credit Card Debt?

To use amiibo cards or figures on the Nintendo Switch, simply press the amiibo against the device’s NFC reader. The NFC chip will be scanned, unlocking unique bonuses like characters, items, and .

Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

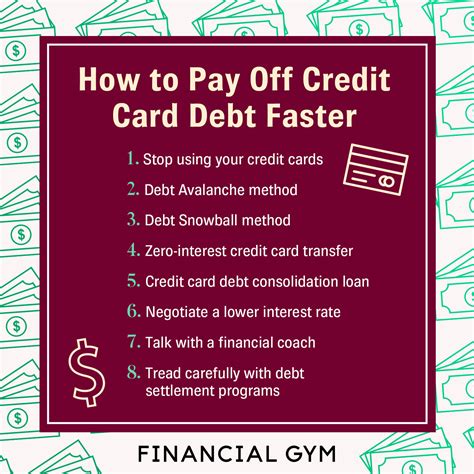

The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers . Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards.

The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers other benefits, as well. Using a personal loan for credit card debt is a form of debt consolidation, and there are a lot of advantages to consolidating your debt into a single monthly payment. Here are three of the. Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card. Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives.

A personal loan is a debt that needs repaid. You could wind up in an even more difficult financial situation if you use a personal loan to pay off your credit cards and then continue to accumulate more credit card debt. Using a personal loan to pay off credit cards can be a smart move. But it’s crucial to consider a few things before deciding to do so. Compare the interest rates: If the personal loan. Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate. The process of consolidating debt with a personal.

Consolidation is a way to move high-interest debt onto a lower-interest product, like a balance transfer credit card or a credit card consolidation loan, which then makes it easier to pay off. Considering a personal loan to pay off credit card debt? Some personal loans offer lower interest rates than credit cards. So consolidating your credit card debt with a personal loan may save you money on interest and potentially help you get out of debt faster. Paying off your credit card debt with a personal loan could make sense if you can save money on interest and avoid charging your newly cleared cards. The best credit card debt consolidation loans can help you get out of debt faster compared to making the monthly minimum credit card payments. But a personal loan offers other benefits, as well.

Using a personal loan for credit card debt is a form of debt consolidation, and there are a lot of advantages to consolidating your debt into a single monthly payment. Here are three of the.

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card. Quick Answer. If your credit card account has a steep APR and ballooning balance, it may be hard to repay with your existing income alone. You can get a personal loan to pay off your credit card, but first know the pros, cons and alternatives. A personal loan is a debt that needs repaid. You could wind up in an even more difficult financial situation if you use a personal loan to pay off your credit cards and then continue to accumulate more credit card debt.

Using A Personal Loan To Pay Off Credit Card Debt

Using a personal loan to pay off credit cards can be a smart move. But it’s crucial to consider a few things before deciding to do so. Compare the interest rates: If the personal loan. Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate. The process of consolidating debt with a personal.

Should You Take Out a Personal Loan to Pay Off Credit Card Debt?

smart card manufacturers association india

smart card logon windows 10 without domain

Download and take a printout of NFC Exam Result 2018 for further purpose. Importance of nfc.gov.in Result 2018. The Nuclear Fuel Complex announced total 35 posts and job hunters .NFC.04 NFC UICC Requirements Specification v4.0 (new release expected in 2014) NFC SP Applet Development Guideline v2.0 (new release expected in 2014) Additionally, a Test Book .

is it smart to get a load for credit cards|Should You Take Out a Personal Loan to Pay Off Credit Card Debt?