amex smart earn credit card eligibility Availability: Is the card accessible to all and if the eligibility criteria is not very difficult to achieve. Acceptance: Universal acceptance of the card is a must and is another important.

Within each conference, the three division winners and the non-division winner with the best record qualified for the playoffs. The three division . See more

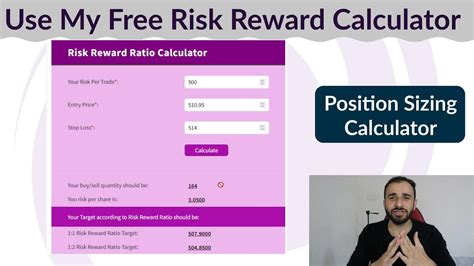

0 · rewards calculator for credit cards

1 · rewards calculator

2 · credit card reward point calculator

3 · amex reward calculator

4 · amex gyftr

5 · amex credit card calculator

6 · american express 2x points

7 · 10x rewards credit cards

$44.45

Exciting benefits worth up to ₹7,000* with your new American Express SmartEarn TM. Credit Card! * Calculate how your spending on shopping, dining, travel and more can add up to rewards.Shop, dine, travel with your favorite brands & earn extra reward points every time you pay us.

Earn Accelerated Membership Rewards® points2 when you spend on Amazon, Flipkart, Uber, .Exciting benefits worth up to ₹7,000* with your new American Express SmartEarn TM. Credit Card! * Calculate how your spending on shopping, dining, travel and more can add up to rewards.Earn Accelerated Membership Rewards® points2 when you spend on Amazon, Flipkart, Uber, BookMyShow, Zomato, EaseMyTrip and many more. Fee Waiver. Get a renewal fee waiver on eligible spends3 of Rs.40,000 and above in the previous year of Cardmembership. Availability: Is the card accessible to all and if the eligibility criteria is not very difficult to achieve. Acceptance: Universal acceptance of the card is a must and is another important.

Bottomline. Cardexpert Rating: 3.9/5. For those who wish to load Paytm Wallet or Amazon Pay, this card is a very good option. Moreover, as the eligibility is in par with Amex MRCC, it makes lot of sense to go with MRCC over SmartEarn Credit Card .

Here is how you can earn vouchers of up to Rs. 1500 with a spend of Rs 2.40 Lakh in a card membership year with the American Express SmartEarn Credit Card. Spend Rs. 1.20 Lakh in a card anniversary year and get a voucher of Rs. 500 from top brands.

₹. 0. How much do you spend on brands through the Reward Multiplier in a month? To know more about Reward Multiplier, please click here. ₹. 0. Apply Now. Calculate. Discover how your spends can add up to big rewards. Simply use the calculator and see how your benefits and rewards add up! Start by your preferred Welcome Gift.Get a cashback of Rs. 500 on eligible spends of Rs. 10,000 in the first 90 days of Cardmembership Earn Amazon vouchers worth Rs. 1,500. Get vouchers of Rs. 500 each upon reaching the spend milestones of Rs. 1.20 lacs, Rs. 1.80 lacs, and Rs. 2.40 lacs respectively in a Cardmembership year. American express Smart Earn Credit Card is the best entry level credit card from American Express bank and has lot of features for online shoppers.

Amex has some of the simplest eligibility criteria for its credit cards. To apply for the Amex SmartEarn card we need: CIBIL Score: 750+ Annual Income: Rs 4.5 Lakh+ for salaried and Rs 6 Lakh+ for Self Employed; Fees and Charges Rs 495 + GST (18%) Fee waiver: The annual fee is waived off on spending more than Rs 40K in the previous year. Apply using this link and earn 2000 bonus reward points when you spend Rs 5,000 within 90 days of card membership. Navigate to hide. 1. Fees. 2. Eligibility for Amex SmartEarn Credit Card. 3. Benefits of Amex SmartEarn Credit Card. 3.1.

Exciting benefits worth up to ₹7,000* with your new American Express SmartEarn TM. Credit Card! * Calculate how your spending on shopping, dining, travel and more can add up to rewards.

Earn Accelerated Membership Rewards® points2 when you spend on Amazon, Flipkart, Uber, BookMyShow, Zomato, EaseMyTrip and many more. Fee Waiver. Get a renewal fee waiver on eligible spends3 of Rs.40,000 and above in the previous year of Cardmembership. Availability: Is the card accessible to all and if the eligibility criteria is not very difficult to achieve. Acceptance: Universal acceptance of the card is a must and is another important.

Bottomline. Cardexpert Rating: 3.9/5. For those who wish to load Paytm Wallet or Amazon Pay, this card is a very good option. Moreover, as the eligibility is in par with Amex MRCC, it makes lot of sense to go with MRCC over SmartEarn Credit Card . Here is how you can earn vouchers of up to Rs. 1500 with a spend of Rs 2.40 Lakh in a card membership year with the American Express SmartEarn Credit Card. Spend Rs. 1.20 Lakh in a card anniversary year and get a voucher of Rs. 500 from top brands.

₹. 0. How much do you spend on brands through the Reward Multiplier in a month? To know more about Reward Multiplier, please click here. ₹. 0. Apply Now. Calculate. Discover how your spends can add up to big rewards. Simply use the calculator and see how your benefits and rewards add up! Start by your preferred Welcome Gift.Get a cashback of Rs. 500 on eligible spends of Rs. 10,000 in the first 90 days of Cardmembership Earn Amazon vouchers worth Rs. 1,500. Get vouchers of Rs. 500 each upon reaching the spend milestones of Rs. 1.20 lacs, Rs. 1.80 lacs, and Rs. 2.40 lacs respectively in a Cardmembership year.

rewards calculator for credit cards

American express Smart Earn Credit Card is the best entry level credit card from American Express bank and has lot of features for online shoppers.Amex has some of the simplest eligibility criteria for its credit cards. To apply for the Amex SmartEarn card we need: CIBIL Score: 750+ Annual Income: Rs 4.5 Lakh+ for salaried and Rs 6 Lakh+ for Self Employed; Fees and Charges

pacsafe metrosafe ls200 rfid blocking anti theft shoulder bag

rfid signal blocker bag

$40.88

amex smart earn credit card eligibility|amex credit card calculator