stealing credit card numbers using rfid People often discover their credit card numbers have been stolen by receiving a transaction notification or bank statement showing an unfamiliar transaction. If your card is still with you, it’s possible someone obtained your information . Depending on the device model and operating system, this setting may be found within the “Wireless & Networks,” “Connection,” or “NFC and payment” section. Upon locating .

0 · rfid embedded credit cards

1 · rfid credit card security tips

2 · rfid credit card security

3 · rfid credit card scam

4 · rfid credit card history

5 · rfid card fraud

6 · how to protect rfid credit cards

7 · are rfid credit cards safe

That was my concolusion after playing with scanning creditcards, with my 12 pro. It also makes sense when pointing it to a payment terminal. Yes, it is up near the top edge of the phone. I learned by paying with the phone. I like .

People often discover their credit card numbers have been stolen by receiving a transaction notification or bank statement showing an unfamiliar transaction. If your card is still with you, it’s possible someone obtained your information . Some security experts have voiced concerns about a phenomenon called RFID skimming, in which a thief with an RFID reader may be able to steal your credit card number or personal information simply by walking within a few feet of you.

People often discover their credit card numbers have been stolen by receiving a transaction notification or bank statement showing an unfamiliar transaction. If your card is still with you, it’s possible someone obtained your information while you were using the card or via an RFID reader. In 2015, security researchers were able to wirelessly steal RFID credit card information (e.g., account numbers and expiration dates) from closely held, unobstructed cards and re-use them.

Use a temporary credit card for online shopping. Many banks and credit companies will offer this service for no fee. You can get a card number that is separate from your actual account, but the bank links it to your account for your bona fide purchases. With contactless payments, thieves can use radio frequency identification (RFID) technology to skim your card’s information if they’re close enough to the card reader. How to protect yourself: Use RFID-blocking wallets or cases .

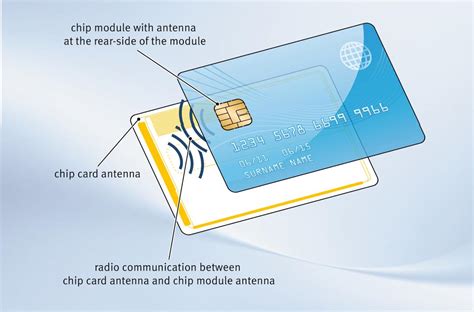

RFID skimming is a method to unlawfully obtain someone's payment card information using a RFID reading device. How RFID skimming is performed. Modern payment cards have a built in chip that transmits card information wirelessly. RFID theft is a misunderstood risk associated with modern technology. While it is theoretically possible to steal someone’s card information using RFID skimmers, the data they get would be missing the necessary identifiers to carry out large scale fraud or in most cases even a simple transaction.

Updated: Oct 21, 2024, 2:21pm. Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. Getty. Card skimming.

Skimming occurs when devices illegally installed on or inside ATMs, point-of-sale (POS) terminals, or fuel pumps capture card data and record cardholders’ PIN entries. RFID credit cards are considered safe to use, and credit card fraud using RFID readers is rare and difficult to do. Some security experts have voiced concerns about a phenomenon called RFID skimming, in which a thief with an RFID reader may be able to steal your credit card number or personal information simply by walking within a few feet of you.People often discover their credit card numbers have been stolen by receiving a transaction notification or bank statement showing an unfamiliar transaction. If your card is still with you, it’s possible someone obtained your information while you were using the card or via an RFID reader.

In 2015, security researchers were able to wirelessly steal RFID credit card information (e.g., account numbers and expiration dates) from closely held, unobstructed cards and re-use them.

murata uhf rfid

rfid embedded credit cards

Use a temporary credit card for online shopping. Many banks and credit companies will offer this service for no fee. You can get a card number that is separate from your actual account, but the bank links it to your account for your bona fide purchases. With contactless payments, thieves can use radio frequency identification (RFID) technology to skim your card’s information if they’re close enough to the card reader. How to protect yourself: Use RFID-blocking wallets or cases .

RFID skimming is a method to unlawfully obtain someone's payment card information using a RFID reading device. How RFID skimming is performed. Modern payment cards have a built in chip that transmits card information wirelessly. RFID theft is a misunderstood risk associated with modern technology. While it is theoretically possible to steal someone’s card information using RFID skimmers, the data they get would be missing the necessary identifiers to carry out large scale fraud or in most cases even a simple transaction.Updated: Oct 21, 2024, 2:21pm. Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. Getty. Card skimming.

Skimming occurs when devices illegally installed on or inside ATMs, point-of-sale (POS) terminals, or fuel pumps capture card data and record cardholders’ PIN entries.

rfid credit card security tips

directional range uhf rfid antenna

Step 1: Go to Settings on your phone. Step 2: Select Apps and then click on See all apps. Step 3: Next, choose NFC service from the list. Step 4: Click on Storage. Step 5: Now click on the Clear Cache button that appears. .

stealing credit card numbers using rfid|are rfid credit cards safe