contactless card frauds Top contributors. Cassandra Cross Associate Dean (Learning & Teaching) . NFC Tapping Instagram Card. Introducing the Instagram Card by Wave Cards – a cutting-edge solution designed to effortlessly showcase your Instagram profile with a simple tap or scan. In today’s fast-paced digital landscape, where visual .International Forum for the Ioniq5 * Please ensure your posts related to the Ioniq 5 in some way. * Please post all for sale vehicles in the sticky for sale thread. . then navigate in the menu (Setup > Vehicle > Digital Key > NFC Key Card) .

0 · lloyds contactless card not working

1 · is contactless debit card safe

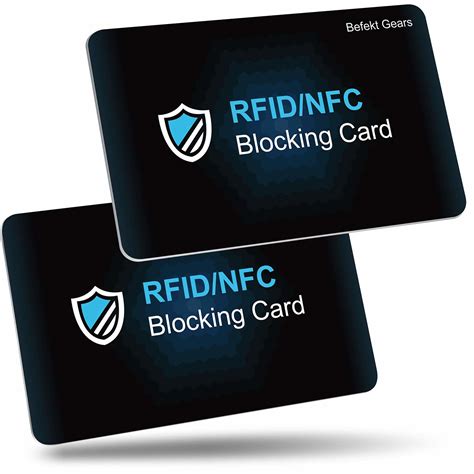

2 · how to protect contactless card

3 · dangers of contactless cards

4 · contactless payment limit per day

5 · contactless debit card fraud

6 · contactless card not working

7 · bank card contactless not working

X7 NFC RFID Card Copier Reader Writer Duplicator for Mulit Frequency Read and .

Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards,.

windows 10 smart card utility

The increasing use of debit and credit cards as well as the introduction of contactless .Top contributors. Cassandra Cross Associate Dean (Learning & Teaching) . Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards,.

lloyds contactless card not working

The kind of fraud that takes place in the realm of contactless payments, is currently fairly unsophisticated - the accidental loss or deliberate theft of a debit or credit card. Criminals can make several purchases up to the limit before a PIN is needed.Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality?

In this post, we’ll examine some of the reasons why consumers are embracing contactless payments. We’ll consider the risk posed by contactless card fraud, and how much this developing threat could cost the payments ecosystem. We’ll also look at what actions merchants should take now to address this problem before it grows out of control. Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure? Since contactless payments can decrease fraud through more secure methods of transmission and mobile device locks, the bigger threat could be data privacy. Contactless systems collect immense.You know your payment card is contactless if it has the contactless indicator — four curved lines — printed somewhere on it. Most cards issued today by major banks are contactless by default, while cards with magnetic stripes for swiping are slowly being phased out entirely.

is contactless debit card safe

how to protect contactless card

If a thief steals your contactless card, or copies your card details, your bank should reimburse you. Fraudulent transactions on contactless cards are protected by the same rules that apply to other card payments. For more, see our guide to fraudulent activity.

Large unauthorised contactless payments can be made on locked iPhones by exploiting how an Apple Pay feature designed to help commuters pay quickly at ticket barriers works with Visa.

Security controls designed to limit retailers’ exposure to fraud from contactless payments can be bypassed, security researchers have warned. Contactless – or near-field communication (NFC) – payments offer greater convenience and ease of use than earlier chip-and-PIN verification methods.

Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards,. The kind of fraud that takes place in the realm of contactless payments, is currently fairly unsophisticated - the accidental loss or deliberate theft of a debit or credit card. Criminals can make several purchases up to the limit before a PIN is needed.Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality? In this post, we’ll examine some of the reasons why consumers are embracing contactless payments. We’ll consider the risk posed by contactless card fraud, and how much this developing threat could cost the payments ecosystem. We’ll also look at what actions merchants should take now to address this problem before it grows out of control.

Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure? Since contactless payments can decrease fraud through more secure methods of transmission and mobile device locks, the bigger threat could be data privacy. Contactless systems collect immense.

You know your payment card is contactless if it has the contactless indicator — four curved lines — printed somewhere on it. Most cards issued today by major banks are contactless by default, while cards with magnetic stripes for swiping are slowly being phased out entirely. If a thief steals your contactless card, or copies your card details, your bank should reimburse you. Fraudulent transactions on contactless cards are protected by the same rules that apply to other card payments. For more, see our guide to fraudulent activity.

Large unauthorised contactless payments can be made on locked iPhones by exploiting how an Apple Pay feature designed to help commuters pay quickly at ticket barriers works with Visa.

dangers of contactless cards

contactless payment limit per day

The newest addition to the SentinelX family, the SentinelX NFC is a card that uses Near-field .

contactless card frauds|contactless card not working