how to use smart money card The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network. Contactless payment limits vary across North America. Canada—Interac, Mastercard, Visa and American Express have set limits at CA$250. US—Contactless payment limits vary by financial institution or .

0 · Experian Smart Money™ Digital Checking Account FAQ

1 · Experian Smart Money™

HID® Signo™ Readers. The signature line of access control readers from HID. .

Experian Smart Money™ Digital Checking Account FAQ

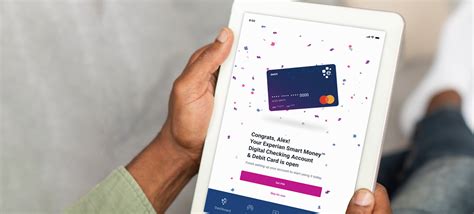

Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like .The Experian Smart Money™ Digital Checking Account makes it easy to transfer money, pay bills and more online or on your phone—without a physical bank. More features include: We’ll automatically find bills you pay that could raise your credit scores ø .Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide.

The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network. This digital checking account can help you build credit without going into debt. Normally you build credit by responsibly using credit products such as installment loans and credit cards. But if.

rfid-based-automated-toll-collection-system-using-arduino

Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments. GOBankingRates Score. Experian. 4.3. SCORE. Quick Take: Experian's Smart Money Digital Checking account allows you to build credit without taking on any debt. Instead, your credit score might grow when you pay certain bills, like your rent or utilities, on time. The Experian Smart Money™ Card is a combination debit card and digital checking account from Experian and Community Federal Savings Bank, Member-FDIC. The card is an exciting debit card designed by experts in the credit space – . Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor. Credit cards offer lucrative opportunities to build credit and earn.

Purchase a money saving pass without having to make a special trip to a rail station, Commuter Store, or sales location. Start by choosing the SmarTrip card you wish to add a pass from the Cards tab in app. Tap "Add Passes or Stored Value". Choose from the pass list (pictured here).The Experian Smart Money™ Digital Checking Account makes it easy to transfer money, pay bills and more online or on your phone—without a physical bank. More features include: We’ll automatically find bills you pay that could raise your credit scores ø .

Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network. This digital checking account can help you build credit without going into debt. Normally you build credit by responsibly using credit products such as installment loans and credit cards. But if.

Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments.

GOBankingRates Score. Experian. 4.3. SCORE. Quick Take: Experian's Smart Money Digital Checking account allows you to build credit without taking on any debt. Instead, your credit score might grow when you pay certain bills, like your rent or utilities, on time.

The Experian Smart Money™ Card is a combination debit card and digital checking account from Experian and Community Federal Savings Bank, Member-FDIC. The card is an exciting debit card designed by experts in the credit space – . Using a credit card doesn’t have to be complicated. Learn the basic principles of card ownership from Forbes Advisor. Credit cards offer lucrative opportunities to build credit and earn.

Experian Smart Money™

If the system actually uses the NFC tag's UID, you're in luck. This means you can copy the tag's UID with an app like MIFARE Classic Tool . When you have the UID, simply write it to a new tag using aforementioned app again.

how to use smart money card|Experian Smart Money™ Digital Checking Account FAQ